External Initiatives and Membership Associations

Collective action for positive change

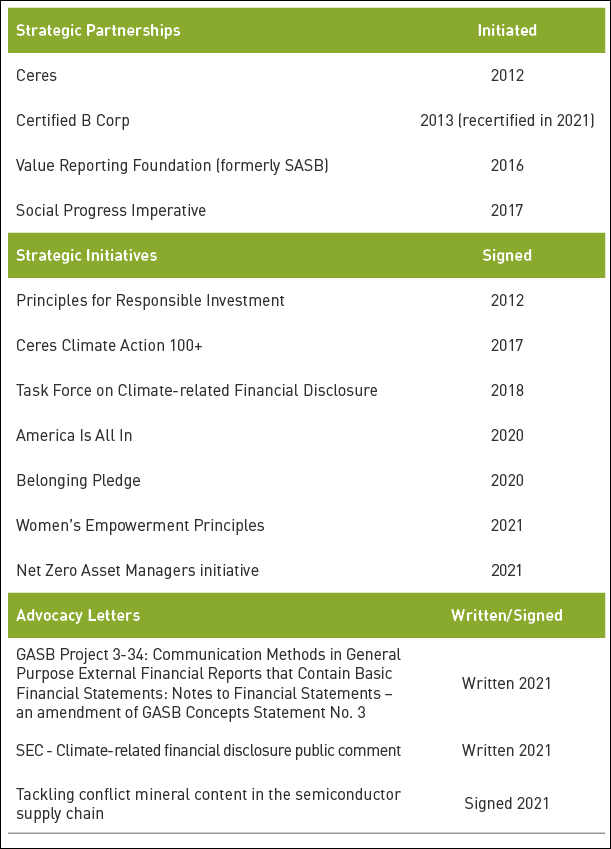

In addition to focusing on our own corporate social responsibility, we seek to advocate for system-level change. We support organizations that are using their expertise to lead the way for progress in areas like climate change, diversity and improved sustainability reporting. Our intention in these efforts is to advance sustainability practices, ESG research and related efforts. These efforts also embed sustainability into our corporate culture. By supporting and partnering with these organizations, we aim to create long-term value for our clients and the broader investor community. Presented here is a sample of the organizations we partner with, the initiatives we stand behind, and the advocacy letters we wrote or signed during the reporting period.

Thoughtful perspectives shared with stakeholders

Breckinridge maintained a commitment to sharing insights and perspectives with stakeholders throughout 2021. As our communities sought to shake off the restrictions imposed by the pandemic, we undertook a series of communications intended to support a safe return to more normal levels of activity.

These efforts were in addition to ongoing monthly and quarterly programs, that include monthly and quarterly market commentaries from our investment committee and its individual members, personalized client reporting, our quarterly newsletter focused on ESG and sustainability topics, and industry conference participation.

Entering the new year following an intense Presidential election, pandemic relief programs intended to support individual and economic recovery were the subject of in-depth reviews on our website:

- Georgia Runoff Elections Shift 2021 Outlook

- Still Work to Do for Many Municipal Issuers After Credit-positive American Rescue Plan

- The Bipartisan Infrastructure Bill Is an Imperfect Credit Positive for the Muni Market

Heightened attention to key social issues extended from 2020 to 2021. At Breckinridge, we acknowledge the material influence social equity in many forms can have on corporate and municipal bonds. Published commentaries helped maintain the focus on these prominent issues, including:

- The Future Benefit of Gender Lens Investing

- Closing the Gender Gap

- Engaging with the Tech Sector on Diversity, Equity, and Inclusion

- Diversity, Equity, and Inclusion Keys LGBTQ+ Action at Breckinridge

Early in 2021, Breckinridge published Investment Grade without ESG Isn’t Really Investment Grade, a comprehensive report on our survey of institutional investors conducted in association with Greenwich Associates. The survey established that the institutions responding to the study are using ESG in investment grade fixed income more than any other asset class. The survey concluded that the connection between high grade bonds and ESG are so strong that investors should consider investment grade fixed income as a foundational asset class for the broader integration of ESG into their organizations and investment processes.

Breckinridge also published an in-depth review of its issuer engagement efforts across corporate, municipal and securitized bond markets in 2021. Addressing the Materiality of Climate Change Risk through Issuer Engagement is a comprehensive look at our work directly with bond issuers and industry experts on material topics related to ESG, financial and operational sustainability.

Additional reporting on news and trends among investing communities that we serve included:

- Giving and Investing Trends Converge for More Powerful Philanthropy

- College Towns Provide Economic Resilience

- College, University E&Fs Incorporate ESG Approaches in Response to Stakeholders

- USCCB Updates Investing Guidelines to Address ESG Principles, Fossil Fuels, and Engagement

Breckinridge also added education content to Breckinridge.com to support increased understanding of investing and ESG with a Financial Glossary and an ESG Investing toolkit.

During 2021, Breckinridge employees were quoted in various investment and ESG-related articles in major news outlets such as Bloomberg, The Bond Buyer, Chief Investment Officer, CNBC, CNN, Financial Advisor, The Financial Times, FundFire, International Financing Review, Institutional Investor, Life and Health Advisor, MarketWatch, Pensions & Investments, U.S. News and World Report, and The Wall Street Journal, for example.

Our employees also offered their time at industry conferences during the year. Breckinridge supported several events as sponsor(*).

- Pension Bridge ESG Summit 2021*

- Climate Action Pursuit* (4 events)

- Confluence Philanthropy Annual Gathering

- CleanTech IQ - ESG in Fixed Income & Finance Digital Forum*

- Sustainable Investment Forum North America*

- Evening with Ceres*

- Volcker Alliance Special Briefing*

- Fixed Income Analysts Society: Sustainable Municipal Investing Panel

- VRF/SASB Symposium*

Persistence Toward Progress

Every endeavor includes challenges. In this report, we hope to have demonstrated that in the face of challenges, persistence will endure as we progress toward our goals. Our 2021 corporate sustainability report highlights work we have undertaken during the year as defined by the values we hold as a company, as employees and as members of our communities. Proud of our accomplishments toward greater operational sustainability at Breckinridge, we also are open and transparent about the work that lies ahead of us. Our goal is to persist in our progress. We look forward to documenting our further accomplishments during the year ahead and reporting to our stakeholders.

DISCLOSURES:

GRI 102-12

GRI 102-13

TCFD Risk Management A

TCFD Metrics & Targets A